Blogs

Go into the number in the preprinted parentheses (since the a bad number). The amount away from Form 2555, range 45, was deducted on the most other quantities of money noted on lines 8a as a result of 8c and you satbets.org site will lines 8e as a result of 8z. Complete the International Made Tax Worksheet for those who enter an matter to the Mode 2555, range forty-five. You should receive a questionnaire 1099-G proving inside box step one the complete unemployment compensation paid back to help you your inside the 2024. For those who operate a corporate or skilled your own career because the a best holder, declaration your earnings and expenditures for the Plan C. If you acquired a type 1099-K to own a personal items you ended up selling at the an increase, never declaration so it count regarding the admission place on the top from Plan step one; alternatively report it as you might statement all other financing acquire to your Form 8949 and you will Plan D.

Kind of Dvds

Sometimes, we may label you to definitely answer the inquiry, or charge a fee more details. Don’t install communication for the tax go back except if the fresh interaction describes an item for the return. Efforts designed to which financing will be shared with the area Department to your Aging Councils out of California (TACC) to incorporate advice on and sponsorship from Older persons points. In this case, mount a duplicate of your own federal Form 1040 otherwise 1040-SR go back and all of help federal variations and you may dates to form 540. Third party Designee – If you’d like to let your preparer, a friend, cherished one, or other people you determine to mention your own 2024 taxation go back to the FTB, read the “Yes” field regarding the trademark area of their taxation come back.

You may have no licensed dividends away from XYZ Corp. because you kept the brand new XYZ inventory for under 61 days. Should you get a 2024 Function 1099-INT for U.S. discounts bond interest filled with numbers you advertised before 2024, see Bar. Don’t tend to be attention gained on your own IRA, wellness family savings, Archer or Medicare Virtue MSA, or Coverdell training checking account. While you are typing numbers that include dollars, make sure to are the quantitative section. When you have to include two or more amounts to find the total amount to go into on the a column, is cents when incorporating the newest quantity and you may round from only the full. A registered domestic spouse in the Vegas, Arizona, otherwise Ca need fundamentally report 1 / 2 of the newest mutual community income of the person as well as their domestic partner.

When tend to my repayments to work?

Provided the appropriate criteria is actually fulfilled, this should allow it to be just one in order to claim an exemption to the selling a business so you can a member of staff collaborative. Budget proposed income tax laws so you can facilitate the creation of worker possession trusts (EOTs). These legislative proposals are presently before Parliament inside the Bill C-59.

People who do not post the brand new percentage digitally will be subject so you can a 1percent noncompliance punishment. Ca law adjusts to help you federal law which allows parents’ election so you can statement a child’s interest and you may dividend income of a kid below many years 19 or an entire-date scholar lower than decades 24 to the father or mother’s income tax come back. If you would like amend your own Ca resident taxation return, complete a revised Function 540 2EZ and check the container at the the top Setting 540 2EZ demonstrating Revised go back. Install Plan X, California Explanation of Revised Come back Transform, to the amended Function 540 2EZ. To have certain instructions, come across “Tips for Filing a 2024 Amended Return”.

Didn’t have the complete basic and you may next repayments? Claim the newest 2020 Recovery Rebate Borrowing from the bank

Attach an announcement checklist the fresh day and you will year of one’s other plans. None of your own refund try nonexempt in the event the, around your repaid the fresh tax, either you (a) don’t itemize deductions, or (b) selected so you can subtract condition and you can regional standard transformation taxes unlike condition and you can local taxes. Where’s My personal Reimburse cannot tune refunds that will be claimed on the an enthusiastic amended tax go back. To evaluate the brand new position of one’s reimburse, see Internal revenue service.gov/Refunds otherwise make use of the totally free IRS2Go app, around the clock, all week long. Factual statements about their refund will generally be available in 24 hours or less pursuing the Internal revenue service get their age-recorded return or 30 days once you send a newspaper return. But if you filed Setting 8379 together with your come back, make it 14 months (eleven weeks for many who recorded electronically) prior to examining the refund condition.

It is because the newest have a tendency to temporary character away from student homes and also the unique GST/HST regulations you to definitely apply to these types of agencies. These requirements is actually premised to the thought of a common money firm being widely stored. Although not, a corporation controlled by a business class can get meet the requirements while the a great mutual financing corporation even though it is maybe not generally stored. The money Tax Operate has unique legislation to possess common fund companies one to helps conduit means to fix people (shareholders). Such as, these types of laws fundamentally ensure it is investment development know because of the a common finance company becoming handled while the investment progress know from the their traders. At the same time, a shared financing corporation isn’t at the mercy of draw-to-business income tax and will elect funding growth procedures on the temper of Canadian securities.

This will is people suggestion income you didn’t report to your employer and any allocated resources revealed in the package 8 in your Mode(s) W-dos if you don’t can be your unreported tips is actually quicker compared to number in the box 8. Likewise incorporate the value of one noncash information your obtained, such as tickets, entry, or other items of well worth. As you don’t statement such noncash ideas to your boss, you must report her or him on line 1c. If the a mutual come back, have their spouse’s earnings away from Function(s) W-dos, field step 1.

While the Form 2210 is actually complicated, you could potentially exit range 38 empty and also the Irs tend to shape the brand new penalty and you will deliver a statement. We would not cost you interest on the punishment for those who pay because of the day given to the bill. You’ll find situations where the fresh Internal revenue service are unable to profile their penalty for you and you should file Form 2210. In case your Exemption just explained does not apply, understand the Instructions for Function 2210 to other points where you might be capable reduce your punishment by the processing Function 2210.

Stop government entities Pension Counterbalance create raise monthly pros within the December 2025 because of the typically 700 to have 380,100 readers getting pros centered on life style partners, with regards to the CBO. The rise was on average step 1,190 to have 390,one hundred thousand or thriving partners getting a good widow otherwise widower benefit. This type of pros will also build over the years in accordance with Public Security’s cost-of-life style adjustments. Changes will also apply to advantages from January 2024 ahead, meaning particular receiver will also discovered straight back-old money. One of several eligibility requirements to own a good GST Leasing Promotion is that the equipment is actually for enough time-name rental.

The utilization taxation has been around feeling inside California while the July 1, 1935. It applies to purchases of merchandise for usage inside California from out-of-county sellers which can be similar to the transformation tax paid back to the requests you make in the California. For those who have maybe not already repaid all of the play with taxation on account of the newest Ca Department away from Taxation and you will Fee Management, you happen to be capable report and you can pay the fool around with tax due on your county tax go back. See the advice below plus the tips to possess Range twenty six away from your earnings income tax go back. Firefighters First Credit Union will bring epic services in order to firefighters in addition to their household across the country.

A boost for lender deposits

Tend to my month-to-month Social Defense payment raise otherwise decrease in March 2025? Of numerous beneficiaries should expect a small escalation in monthly payments due to the yearly Costs-of-Lifestyle Changes (COLA). Although not, certain high-earnings readers may see smaller pros otherwise improved taxation on the Personal Shelter income according to the the fresh money brackets. Yet not, this type of alter include pressures, as well as staffing incisions as well as the healing out of overpaid professionals.

Utilize the Where’s My personal Amended Get back application on the Irs.gov to trace the fresh status of the revised get back. It will take around 3 months on the date you shipped it to show up within program. You can file Function 1040-X digitally with taxation filing app to help you amend Variations 1040 and you can 1040-SR. See Internal revenue service.gov/Filing/Amended-Return-Frequently-Asked-Issues to find out more. Section D—Play with should your submitting status is Head of household. Generally, people you pay to set up your get back have to signal it and you will were the Preparer Tax Identification Matter (PTIN) in the area offered.

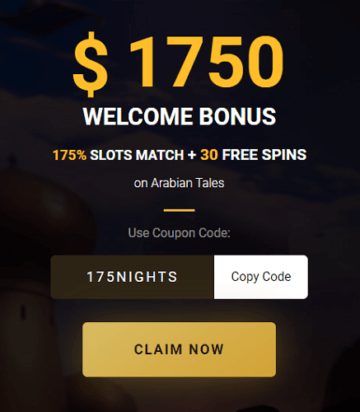

When you use particular advertising blocking app, delight consider their configurations. A deck created to showcase all of our perform aimed at using the vision from a reliable and more clear online gambling world to help you truth. Free elite group academic courses to own online casino personnel aimed at world recommendations, boosting player experience, and you will reasonable method of playing.